Pensions… What a nightmare, eh? The Swedish pension system looks incredibly complicated from the outside. Well, to be honest, it looks pretty complicated from the inside, too.

Why are there so many different pensions? What do they all do? And which ones are you eligible for?

You might think that if you’re not working here then you’re not eligible for a pension. But that’s not true. If you are registered as living here in Sweden, you are eligible for some form of allmän pension (national public pension), even if you don’t have a job.

Before we dive deeper into allmän pension and what you will receive, we need to get an overview of the whole pension system in Sweden.

Buckle up! You’re in for a ride.

The (many) Swedish pensions

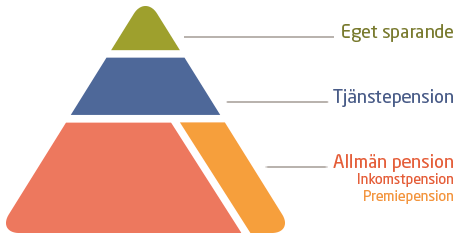

Pensionsmyndigheten (the Swedish Pensions Agency) helpfully provide a diagram to explain the different pensions. This is a great start in getting your head around just how pensions work here.

The orange layer at the bottom is the allmän pension (national public pension) that everyone who lives or works in Sweden is eligible to receive. The next layer, in dark blue, is the tjänstepension (occupational pension) from your employer, if you have a job. And at the top, in green, is privat pension – any private pension that you might have set up for yourself.

We’re going to focus on allmän pension (national public pension) since that is the one that everyone is eligible for.

It is made up of three parts:

- Inkomstpension (income pension) – 16% of your annual income each year is allocated here. In this context, “income” means earnings from an employer or from your own business (if you are self-employed) parental leave benefits, unemployment or sickness benefits, or disability compensation.

- Premiepension (premium pension) – 2.5% of your annual income is allocated here. Again, this “income” is more than just earnings from an employer.

- Garantipension (guarantee pension) – this is the important part if you don’t have a job and are not registered with Arbetsformedlingen (the Swedish Public Employment Service) as either unemployed or on sickness benefits. The garantipension is for those who have not worked or have not had enough income over their working life in Sweden. How much garantipension you are paid on retirement depends on whether you are married or not (a married person gets slightly less) and how much the rest of your allmän pension is (ie how much inkomst- and premiepension you are getting). However, as the garantipension is based on your entire working life in Sweden, there isn’t too much to think about until you come to retirement age.

After all that, are you still with us? We hope so!

The bottom line is that you want to try and earn as much as you can towards the inkomst- and premiepension parts of your allmän pension, but you know that if you can’t, the state does offer a safety net (garantipension).

And if you leave to live in another country, when you retire you’ll still be eligible to apply for the inkomst- and premiepension parts of your allmän pension you earned during your years in Sweden. Yippee!

Checking in with your pension

Once a year, you’ll receive an update from Pensionsmyndigheten. This is known as the orange kuvert (the orange envelope) because it used to be sent in the post in – you’ve guessed it – an orange envelope. It is now sent digitally to you. It will tell you how much your inkomst- and premiepension are now worth, what the value change over the past year has been, and how much you’ll get from them each month after retirement (assuming your “income” remains the same for the rest of your working life in Sweden).

You also can keep an eye on your pension more frequently by logging into Min Pension with your BankID.

Min Pension is a joint venture between Pensionsmyndigheten and all the different pension providers in Sweden. It gathers together information about all the pensions you might have: allmän (state), tjänste (company), or privat (private).

Once you’ve logged in to Min Pension, you can see an overview of your pensions and how much the system calculates you’ll receive each month after retirement from all your different pensions. This is really useful information. You can also make sure that it has the most recent totals from all your pensions by clicking on the tab called Insamlingsstatus and then clicking on the Uppdatera uppgifter button.

It will take about 24 hours for it to go through all your pensions and update the overview, but it’s worth it. Just leave the internet window open and it will sit there and pull in all the information.

Unleash in your inner nerd on the front page by playing around with the pensionsprognos (pension projection) chart by changing your retirement age to see what happens to your monthly pension payouts should you retire earlier or later.

The projection is based on you earning your current income for the rest of your working life. If you change salary, set yourself up as self-employed, etc, you can change the monthly income level that it uses to calculate your pension projection. In the chart, click on the link called Inställningar and then simply fill in your new income level and save. Hey presto, the pensionsprognos on the front page will adjust.

Having fun with your pension

Yes, we’re sure that you probably read that and thought we must be joking, but there is a way to make your state pension more fun. Yes, honestly!

The money that goes into the inkomstpension part of your allmän pension is invested for you, but you can invest the funds in the premiepension part yourself. Woo hoo!

Initially, the money is automatically invested in a government-run fund called AP7 Såfa. But you can switch it into up to five other funds.

This is an excellent opportunity to take control of your pension in a way that might not be possible with a company pension. It also offers you a chance to diversify your pension money and make sure that you don’t have it all invested in the same type of funds as your company pension, for example.

To change from the AP7 Såfa fund, you’ll need to log into Pensionsmyndigheten. (If you have previously logged into Min Pension, you’ll see the same pensionsprognos on the Mina Sidor overview page).

Scroll almost all the way down the overview page until you come to a section called Premiepension. You’ll see three boxes with figures:

- Värdeförändring – Change in value, showing how much it has changed in value so far this year, and the average annual change in value since start.

- Portföljens avgift – portfolio fees, and the average for all premiepension holders in Sweden

- Totalt värde – total value

Underneath are three important buttons:

- Se dina fonder – see your funds, which shows you which funds your premiepension is invested in.

- Byt fonder – change funds, where you can change which funds you invest your premiepension in. (You can always change back to the AP7 Såfa fund, which has one of the lower annual fees, if you want to.)

- Se dina pensionskonton – see your pension accounts, which shows you how much both your inkomstpension and your premiepension are worth.

If you want to change from the AP7 Såfa fund, you can see all the available funds listed on the Byt fonder page. You can filter them by geographical region, risk level, annual fee, fund provider, and even choose only those that invest sustainably or have a low carbon dioxide risk.

They say that knowledge is power. Pension wisdom is your new superpower. Use it. Log in and see what you’ve earned so far. And spread the word. Let’s make sure that we all know about what pensions we are entitled to.

If you want to know more about Swedish pensions, how being self-employed affects them, for example, or what you need to earn to get the maximum amount in your inkomstpension, or the nitty gritty of the garantipension, look out for a dedicated section on the topic in the coming Thrivalist’s Guide to Life in Sweden with Kids, by Jill Leckie and Katharine Trigarszky.

Quick facts

- You don’t need to be employed to be accumulating a state pension (allmän pension). If you have received parental benefits, unemployment or sickness benefits, or disability compensation, the state will allocate 18.5% of this “income” into an allmän pension for you (16% into an inkomstpension and 2.5% into a premiepension).

- If, by the time you retire, you haven’t earned much or anything at all in Sweden, you are still eligible for a small pension from the government. This is called a garantipension and is paid out after your retirement if you are still living in Sweden.

- Even if you have left Sweden by the time you retire, you are still eligible to claim the inkomst- and premiepension parts of your state pension.

- You can invest your premiepension into up to five different funds, or simply leave it in the AP7 Såfa fund that it is automatically invested in.

- You can see how much allmän pension you have earned so far, what it is worth, and how much it will pay out on retirement by logging into Min Pension. You can also see any company or private pensions that you might have on this page as well.

- If you think you are entitled to more allmän pension than you can see on Min Pension, be sure to contact Pensionsmyndigheten.